Food stamps, also known as the Supplemental Nutrition Assistance Program (SNAP), provide financial assistance to low-income individuals and families to purchase groceries. Overtime pay, which is earned when an employee works more than their regular scheduled hours, can impact SNAP eligibility and benefits.

This article will explore how overtime pay is counted as income for SNAP, the potential impact on benefits, and strategies for maximizing SNAP benefits while working overtime.

Understanding the interplay between overtime pay and SNAP eligibility is crucial for individuals and families who rely on this assistance program. By providing clear information and guidance, this article aims to empower readers to make informed decisions about their income and SNAP benefits.

Definition and Eligibility for Food Stamps

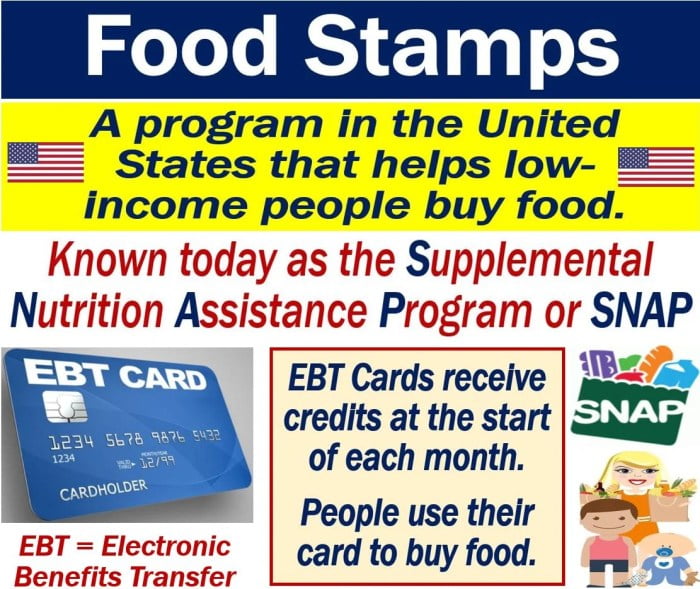

The Supplemental Nutrition Assistance Program (SNAP), commonly known as food stamps, is a federal nutrition assistance program administered by the United States Department of Agriculture (USDA). SNAP provides eligible low-income individuals and families with monthly benefits to purchase food.

To be eligible for SNAP, households must meet certain income and asset limits. Income limits vary by household size and state of residence. In general, households with incomes below 130% of the federal poverty level are eligible for SNAP. Asset limits are also considered, but they are more generous than income limits.

Overtime Pay and SNAP Eligibility

Overtime pay is counted as income for SNAP purposes. This means that households receiving overtime pay will have their SNAP benefits reduced or eliminated, depending on the amount of overtime pay they receive.

Impact of Overtime Pay on Food Stamp Benefits

Overtime pay can have a significant impact on Supplemental Nutrition Assistance Program (SNAP) benefits, commonly known as food stamps. When an individual’s income increases due to overtime pay, it can potentially reduce their SNAP benefits or even make them ineligible for the program.

Reduction in Benefits

SNAP benefits are determined based on household income and size. Overtime pay increases an individual’s income, which can push their household income above the SNAP eligibility threshold. As a result, their SNAP benefits may be reduced or eliminated. The amount of reduction depends on the amount of overtime pay earned and the household’s other income sources.

Loss of Eligibility

In some cases, overtime pay can cause an individual to lose their SNAP eligibility altogether. This can occur if the household’s income exceeds the gross income limit for SNAP. The gross income limit is the maximum amount of income a household can have and still qualify for SNAP benefits.

Example

For instance, consider a household with a monthly income of $1,500. This household qualifies for SNAP benefits. However, if one member of the household earns $500 in overtime pay, their household income increases to $2,000. This exceeds the gross income limit for SNAP, resulting in the loss of their SNAP benefits.

Strategies for Maximizing Food Stamp Benefits

Managing overtime pay can be a challenge for individuals receiving food stamps. By understanding the impact of overtime on benefits and implementing effective strategies, you can minimize the impact and maximize your food stamp assistance.

To effectively manage overtime pay and maximize food stamp benefits, consider the following strategies:

Budgeting and Financial Planning

Create a realistic budget that Artikels your income and expenses. Allocate funds for essential expenses such as housing, utilities, and transportation. Determine how much you can allocate towards food expenses while staying within your budget.

Consider setting up a separate savings account for food stamp benefits. This will help you track your spending and prevent overspending.

[detailed content here]

[detailed content here]

Alternative Income Sources and Food Stamp Eligibility

Understanding how alternative income sources, such as self-employment or investments, affect your Supplemental Nutrition Assistance Program (SNAP) eligibility is crucial. When applying for SNAP, it’s essential to disclose all sources of income accurately. Failure to do so may result in overpayment or disqualification from the program.

Reporting Additional Income

When applying for SNAP, you must report all sources of income, including self-employment earnings, investment income, and any other financial gains. This information is used to calculate your gross income and determine your eligibility for the program. If you fail to report additional income, you may receive more benefits than you’re entitled to, which could lead to repayment or legal consequences.

Fluctuations in Income

SNAP benefits are based on your household’s monthly income. If your income fluctuates, it’s important to report these changes promptly to your local SNAP office. Fluctuations in income can affect the amount of SNAP benefits you receive. For instance, if your income increases, your benefits may decrease or you may no longer be eligible for the program.

Conversely, if your income decreases, you may qualify for increased benefits.

State-Specific Variations in Food Stamp Policies

Food stamp policies, including how overtime pay is counted as income, can vary from state to state. These variations are due to differences in state laws and regulations.

In general, overtime pay is counted as income when determining food stamp eligibility and benefits. However, some states may have specific rules about how overtime pay is treated. For example, some states may exclude a certain amount of overtime pay from income calculations.

Examples of State-Specific Programs

In addition to the general food stamp program, some states offer additional programs and services to support SNAP recipients. These programs can include:

- Employment and training programs

- Nutrition education programs

- Food pantries and soup kitchens

Final Summary

In conclusion, the impact of overtime pay on food stamps is a complex issue that requires careful consideration. By understanding the eligibility criteria, potential benefit reductions, and available strategies, individuals can navigate the system effectively. It is important to remember that SNAP is a vital resource for low-income households, and it is essential to maximize benefits while ensuring continued eligibility.

Frequently Asked Questions

Does overtime pay always reduce SNAP benefits?

No, overtime pay may not always reduce SNAP benefits. In some cases, the increased income from overtime may be offset by deductions or expenses, resulting in no change or even an increase in benefits.

How is overtime pay counted as income for SNAP?

Overtime pay is typically counted as earned income for SNAP purposes. This means that it is added to the applicant’s or recipient’s regular wages and other sources of income.

What strategies can I use to minimize the impact of overtime pay on SNAP benefits?

Strategies to minimize the impact of overtime pay on SNAP benefits include budgeting and financial planning, exploring alternative income sources, and seeking professional guidance if needed.