Navigating the complexities of government assistance programs can be daunting, but understanding the eligibility criteria for programs like Texas Food Stamps is crucial for those in need. This comprehensive guide will delve into the intricacies of the Texas Food Stamp program, specifically focusing on the income limits that determine eligibility.

We will explore the purpose and history of the program, the income eligibility guidelines, asset limits, and the verification process. Additionally, we will provide a step-by-step guide to applying for Texas Food Stamps and address frequently asked questions to ensure a thorough understanding of the program.

The Texas Food Stamp program, also known as the Supplemental Nutrition Assistance Program (SNAP), plays a vital role in providing food assistance to low-income individuals and families. Understanding the income limits associated with the program is essential to determine eligibility and access these benefits.

This guide will provide a clear and concise overview of the income eligibility guidelines, empowering individuals to make informed decisions about their participation in the program.

Texas Food Stamp Income Limits Overview

Texas Food Stamps, also known as the Supplemental Nutrition Assistance Program (SNAP), is a federal nutrition assistance program administered by the Texas Health and Human Services Commission (HHSC). SNAP provides monthly benefits to eligible low-income individuals and families to help them purchase food.To

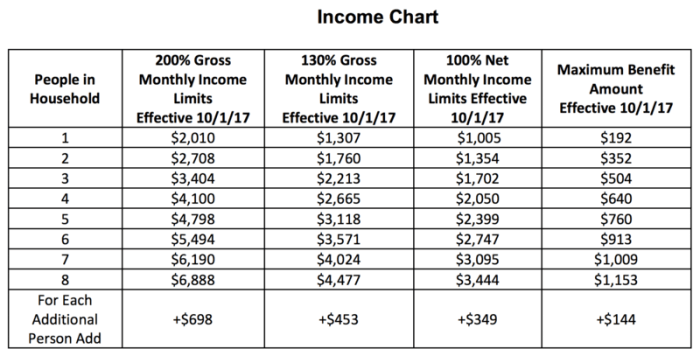

be eligible for Texas Food Stamps, you must meet certain income and resource requirements. Your income must be at or below 130% of the federal poverty level, and your resources must be below certain limits. The income limits are adjusted each year based on changes in the federal poverty level.In

2023, the gross income limits for Texas Food Stamps are as follows:* Household Size Gross Monthly Income Limit

- 1 $1,839

- 2 $2,463

- 3 $3,087

- 4 $3,711

- 5 $4,335

- 6 $4,959

- 7 $5,583

- 8 $6,207

- For each additional person, add $624

If your income is above the gross income limit, you may still be eligible for Texas Food Stamps if you have high expenses, such as medical bills or childcare costs. You can deduct certain expenses from your gross income to calculate your net income.

The net income limit for Texas Food Stamps is 100% of the federal poverty level.In 2023, the net income limits for Texas Food Stamps are as follows:* Household Size Net Monthly Income Limit

- 1 $1,407

- 2 $1,866

- 3 $2,326

- 4 $2,785

- 5 $3,245

- 6 $3,704

- 7 $4,164

- 8 $4,623

- For each additional person, add $450

If your income and resources are within the limits, you may be eligible for Texas Food Stamps. To apply for Texas Food Stamps, you can visit your local HHSC office or apply online at YourTexasBenefits.com.

Income Eligibility Guidelines

To be eligible for Texas Food Stamps (SNAP), you must meet certain income guidelines. These guidelines are based on the number of people in your household and your gross income.

Household Size and Income Limits

- 1 person: $2,543 per month

- 2 people: $3,458 per month

- 3 people: $4,373 per month

- 4 people: $5,288 per month

- Each additional person: add $820 per month

Determining Household Income

Your household income includes all income from all members of your household, including wages, salaries, tips, self-employment income, Social Security benefits, and child support. It does not include certain types of income, such as Supplemental Security Income (SSI) or Temporary Assistance for Needy Families (TANF).

Exceptions and Special Considerations

There are some exceptions to the income limits. For example, you may be eligible for Food Stamps even if your income is slightly over the limit if you have high medical expenses or other special circumstances.

If you are not sure whether you are eligible for Food Stamps, you can apply online or at your local Department of Family and Protective Services (DFPS) office.

Asset Limits

Texas Food Stamps have asset limits that determine eligibility. Assets are resources owned by an individual or household, such as cash, bank accounts, stocks, and real estate.The asset limit for Texas Food Stamps is $2,500 for individuals and $4,000 for households with two or more people.

This limit does not include the value of a home or vehicle.

Countable Assets

Countable assets are those that can be easily converted into cash. They include:

- Cash

- Bank accounts

- Stocks

- Bonds

- Mutual funds

- Certificates of deposit

- Prepaid debit cards

- Gift cards

- Real estate (other than the home)

Non-Countable Assets

Non-countable assets are those that cannot be easily converted into cash. They include:

- The home

- One vehicle

- Personal belongings (such as clothing, furniture, and appliances)

- Retirement accounts (such as 401(k)s and IRAs)

- Life insurance policies

- Burial plots

Assets are valued at their current market value. For example, a car is valued at its current selling price.Assets that exceed the asset limit will reduce the amount of Food Stamps that a household is eligible for. For example, if a household has $3,000 in countable assets, they will have their Food Stamp benefits reduced by $50 per month.

Verification Requirements

Providing accurate and complete information is crucial for determining SNAP eligibility. Applicants must verify their income and assets to ensure that they meet the eligibility criteria. Failure to provide the necessary documentation can delay or even deny benefits.

Income Verification

Applicants must provide proof of all income sources, including wages, self-employment income, Social Security benefits, and unemployment benefits. Acceptable documents include:

- Pay stubs

- Tax returns

- Bank statements

- Award letters from government agencies

Asset Verification

Applicants must also provide information about their assets, such as cash, bank accounts, stocks, and real estate. Acceptable documents include:

- Bank statements

- Investment statements

- Deeds or titles to property

Submitting Verification Documents

Applicants can submit verification documents in person, by mail, or through an online portal. The specific method will vary depending on the local SNAP office.

Consequences of Failing to Provide Verification

Failing to provide the necessary verification documents can have serious consequences. The SNAP office may delay or deny benefits, and applicants may face penalties for providing false or misleading information.

Impact on Food Stamp Benefits

Income and asset limits play a crucial role in determining the amount of Food Stamp benefits an individual or household receives. Exceeding these limits can result in reduced benefits or even disqualification from the program.

Changes in income or assets can have a direct impact on Food Stamp benefits. For example, if an individual’s income increases above the eligibility limit, their benefits may be reduced or they may no longer qualify. Similarly, if an individual’s assets exceed the asset limit, they may be ineligible for Food Stamps.

Potential Consequences of Exceeding Income or Asset Limits

- Reduced Food Stamp benefits

- Disqualification from the program

- Repayment of benefits received while ineligible

Applying for Texas Food Stamps

Applying for Texas Food Stamps is a straightforward process that can be completed in several ways. To begin, you’ll need to gather necessary documentation, such as proof of income, identity, and residency. Once you have the required documents, you can apply online, by mail, by phone, or in person at your local Texas Health and Human Services (HHS) office.The

online application is the quickest and most convenient method. You can access the application through the Texas HHS website. The mail-in application can be obtained from your local HHS office or by calling the Texas Food Stamp hotline. To apply by phone, call the Texas Food Stamp hotline at 1-800-252-8263.Once

you have submitted your application, it will be processed within 30 days. If your application is approved, you will receive a Lone Star Card, which you can use to purchase food at authorized retailers.

Closure

In conclusion, the Texas Food Stamp income limit is a crucial factor in determining eligibility for this essential nutrition assistance program. By understanding the income guidelines, asset limits, and verification requirements, individuals can navigate the application process effectively. The Texas Food Stamp program provides a lifeline to low-income households, helping them put food on the table and improve their overall well-being.

We encourage those in need to explore their eligibility and take advantage of this valuable resource.

FAQ Section

What is the income limit for a single person to qualify for Texas Food Stamps?

For a single person household, the gross monthly income limit is $1,645.

What is the income limit for a family of four to qualify for Texas Food Stamps?

For a household of four, the gross monthly income limit is $3,049.

What types of income are counted towards the Texas Food Stamp income limit?

Wages, salaries, self-employment income, Social Security benefits, and child support payments are all counted towards the income limit.

What assets are counted towards the Texas Food Stamp asset limit?

Vehicles, bank accounts, and investments are all counted towards the asset limit, with certain exceptions for essential assets like a primary residence.

What is the penalty for failing to provide verification documents for Texas Food Stamps?

Failure to provide verification documents can result in a delay or denial of benefits.