Food stamps, also known as the Supplemental Nutrition Assistance Program (SNAP), provide financial assistance to low-income individuals and families to purchase food. Eligibility for food stamps depends on several factors, including income and assets. If you rent a room, you may wonder how this affects your eligibility for food stamps.

This guide will provide an overview of the eligibility criteria for food stamps, how renting a room may impact your eligibility, and what you need to know about documenting your income and expenses. We will also discuss special considerations for renters and provide a list of additional resources and support services available.

Eligibility Criteria for Food Stamps

To qualify for food stamps, also known as the Supplemental Nutrition Assistance Program (SNAP), individuals must meet specific eligibility criteria set by the United States Department of Agriculture (USDA). These criteria include income limits and asset limits.

Income Limits

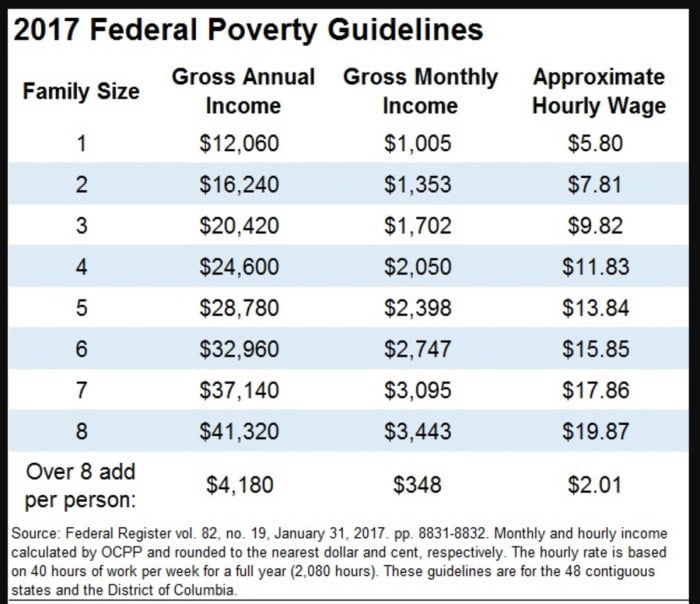

Eligibility for food stamps is based on household income. Households with incomes below 130% of the federal poverty level are generally eligible for food stamps. The poverty level is adjusted annually based on the Consumer Price Index. For example, in 2023, a household of one person with a monthly income of $1,569 or less would be eligible for food stamps.

Asset Limits

In addition to income limits, households must also meet asset limits to qualify for food stamps. Assets include cash, bank accounts, stocks, bonds, and real estate. The asset limit for food stamps is $2,500 for households with one or two people, and $4,000 for households with three or more people.

Renting a Room

Renting a room may affect eligibility for food stamps. If the household is considered a “boarder” or “lodger,” they may not be eligible for food stamps. Boarders and lodgers are individuals who live in another person’s home and pay for their room and board, but do not have access to the kitchen or other common areas of the home.

However, if the household is considered a “tenant,” they may be eligible for food stamps. Tenants are individuals who rent a room or apartment and have their own kitchen and bathroom. To be considered a tenant, the household must have a written lease or rental agreement, and they must be responsible for paying their own rent and utilities.

Types of Income Considered

When determining eligibility for food stamps, a comprehensive list of income sources is taken into account. This includes:

- Wages, salaries, and self-employment income

- Social Security benefits (SSI, SSDI, OASDI)

- Unemployment compensation

- Alimony or child support payments

- Pensions or retirement benefits

- Rental income (including income from renting a room)

Rental Income from Renting a Room

Rental income, including income from renting a room, is considered earned income when determining food stamp eligibility. It is counted as part of the household’s gross income and can affect the amount of food stamps a household is eligible to receive.

To determine the exact amount of rental income that is counted, deductions for reasonable expenses, such as property taxes, mortgage interest, and maintenance costs, may be allowed. These deductions will vary depending on the individual circumstances of the household.

Impact of Rental Expenses on Eligibility

Rental expenses, including rent for the room being rented, are factored into the eligibility determination for food stamps. The amount of rent paid is subtracted from the household’s gross income to calculate the net income. The net income is then compared to the income eligibility limits to determine if the household is eligible for food stamps.There

are some potential deductions or exclusions that may apply to rental expenses. For example, if the household is responsible for paying utilities, such as electricity or gas, the amount of these expenses may be deducted from the rent paid. Additionally, if the household is sharing the rental unit with other people, the rent paid may be prorated based on the number of people living in the unit.

Documenting Rental Income and Expenses

To prove your rental income and expenses for food stamp applications, it’s crucial to maintain accurate documentation. Acceptable forms include:

Rent Receipt

- Must include the landlord’s name, contact information, and signature.

- Clearly state the rental period, amount paid, and address of the rental property.

Utility Bills

- Gas, electricity, water, or trash bills in your name.

- Show the billing period, address, and amount due or paid.

Mortgage Statement

- If you own the rental property, provide a mortgage statement.

- Include the lender’s name, your name, property address, and monthly payment amount.

Rental Agreement

- A written or electronic contract between you and the tenant.

- Artikels the rental amount, payment due date, and lease term.

Income Tax Return

- Form 1040, Schedule E, which reports rental income and expenses.

- Shows the net rental income, which is used to determine eligibility.

Special Considerations for Renters

Renters may face unique challenges when applying for food stamps. Understanding special considerations and programs available can help ensure access to essential food assistance.

Shared Housing Arrangements

Shared housing arrangements, where individuals share a residence but maintain separate living spaces, may impact eligibility. The program considers the entire household’s income and expenses, including shared expenses like rent and utilities. Renters should provide documentation of their individual income and expenses to accurately assess their eligibility.

Additional Resources and Support

Renters who are facing financial challenges and need assistance with food can seek support from various resources and organizations. These services can provide access to food assistance programs, emergency food assistance, and other support services.

Here are some resources and support services available for renters seeking food assistance:

Local Food Banks

- Contact your local food bank for information on food pantries, meal programs, and other food assistance services.

- Find a food bank near you at Feeding America: https://www.feedingamerica.org/find-your-local-foodbank

Community Organizations

- Reach out to community organizations such as churches, soup kitchens, and homeless shelters for food assistance and other support services.

- Contact United Way 2-1-1 for information on local resources and services: https://www.211.org/

Government Assistance Programs

- Explore government assistance programs such as the Supplemental Nutrition Assistance Program (SNAP) and the Special Supplemental Nutrition Program for Women, Infants, and Children (WIC) for eligibility and benefits.

- Visit the USDA Food and Nutrition Service website for more information: https://www.fns.usda.gov/

Final Conclusion

Understanding the eligibility requirements for food stamps and how renting a room may affect your eligibility is essential. By following the guidelines Artikeld in this guide and providing accurate documentation, you can determine your eligibility and access the assistance you need to meet your nutritional needs.

FAQ Section

Can I get food stamps if I rent a room in someone else’s house?

Yes, you may still be eligible for food stamps if you rent a room in someone else’s house. Your eligibility will depend on your income and assets, as well as the income and assets of the other people living in the household.

How is rental income from renting a room treated when determining eligibility for food stamps?

Rental income from renting a room is considered earned income when determining eligibility for food stamps. This means that it will be counted towards your gross income, and it may affect your eligibility if your income exceeds the income limits.

What expenses can I deduct from my rental income when applying for food stamps?

You can deduct certain expenses related to renting a room when applying for food stamps. These expenses may include mortgage interest, property taxes, insurance, repairs, and utilities. You should keep receipts or other documentation to support your deductions.