In Texas, the Supplemental Nutrition Assistance Program (SNAP), commonly known as food stamps, provides vital assistance to low-income households in meeting their nutritional needs. To qualify for SNAP benefits, applicants must meet specific income and asset eligibility criteria. This guide will delve into the income guidelines for food stamps in Texas, outlining the maximum income limits and providing a comprehensive understanding of the program’s requirements.

The income eligibility guidelines for SNAP are established by the federal government and vary based on household size. In Texas, the maximum gross income limits for households of varying sizes are as follows: one person – $1,548; two people – $2,091; three people – $2,634; four people – $3,177; five people – $3,720; six people – $4,263; seven people – $4,806; and eight people – $5,349. For households with more than eight members, an additional $543 is added for each additional person.

Income Eligibility Guidelines

To qualify for food stamps in Texas, your household’s income must be at or below certain limits. These limits are based on the number of people in your household and are adjusted annually.

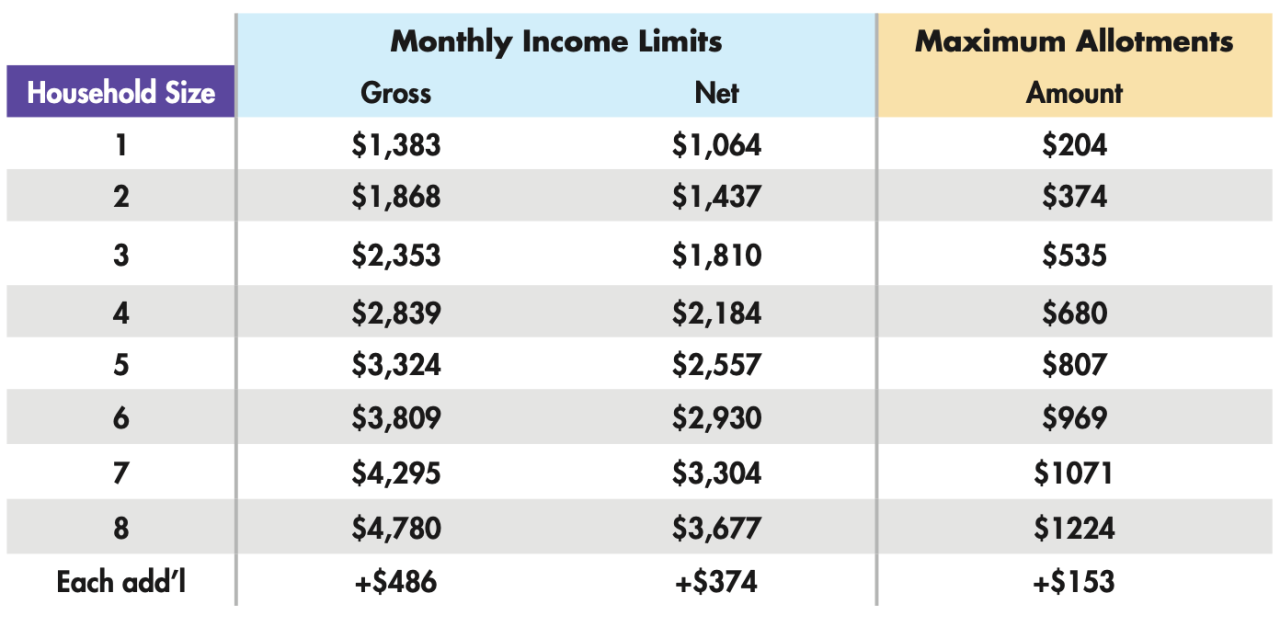

The following table shows the maximum income limits for food stamps in Texas for fiscal year 2023:

| Household Size | Gross Monthly Income Limit | Net Monthly Income Limit |

|---|---|---|

| 1 | $1,747 | $1,291 |

| 2 | $2,356 | $1,732 |

| 3 | $2,965 | $2,173 |

| 4 | $3,574 | $2,614 |

| 5 | $4,183 | $3,055 |

| 6 | $4,792 | $3,496 |

| 7 | $5,401 | $3,937 |

| 8 | $6,010 | $4,378 |

| Each additional person | $609 | $457 |

Gross income is the total amount of money your household earns before taxes or other deductions. Net income is the amount of money your household has left after taxes and other deductions have been taken out.

When determining your household’s income, the following types of income are considered:

- Wages, salaries, tips, and commissions

- Self-employment income

- Social Security benefits

- Supplemental Security Income (SSI)

- Unemployment benefits

- Workers’ compensation benefits

- Child support payments

- Alimony payments

- Certain types of housing assistance

Asset Limits

In addition to income limits, Texas also imposes asset limits for food stamp eligibility. Assets are any resources that you own, such as cash, bank accounts, stocks, bonds, and real estate. The asset limit for food stamps in Texas is $2,500 for individuals and $4,000 for households with two or more people.

However, there are certain assets that are exempt from the limit. These include:

- Your home and the land it is on

- One vehicle per household member

- Retirement accounts, such as 401(k)s and IRAs

- Life insurance policies

- Burial plots

Assets are valued for food stamp eligibility based on their fair market value. This is the price that you could reasonably expect to sell the asset for in the current market.

Work Requirements

In Texas, able-bodied adults without dependents (ABAWDs) between the ages of 18 and 49 are required to work or participate in work activities to receive food stamps. These individuals must work an average of 20 hours per week or participate in a workfare program for 20 hours per week.

Work activities that qualify for food stamps in Texas include:

- Working for a public or private employer

- Participating in a workfare program

- Volunteering for a non-profit organization

- Participating in a job training program

Individuals who are exempt from the work requirements include:

- Individuals with disabilities

- Individuals who are pregnant or caring for a child under the age of 6

- Individuals who are enrolled in a full-time education program

- Individuals who are working at least 30 hours per week

Application Process

Applying for food stamps in Texas involves a straightforward process that can be completed online or through the mail. Whether you choose to apply online or by mail, you will need to provide specific documents to support your application.

To apply online, visit the Texas Health and Human Services website at YourTexasBenefits.com. You will need to create an account and provide information about your household, income, and assets. You can also apply by mail by downloading and completing the application form available on the website and mailing it to the address provided.

Required Documents

- Proof of identity (e.g., driver’s license, state ID card, passport)

- Proof of residency (e.g., utility bill, lease agreement)

- Proof of income (e.g., pay stubs, bank statements)

- Proof of assets (e.g., bank statements, investment statements)

- Social Security numbers for all household members

Benefits

The Supplemental Nutrition Assistance Program (SNAP), formerly known as food stamps, provides monthly benefits to low-income individuals and families to help them purchase food. In Texas, SNAP benefits are administered by the Health and Human Services Commission (HHSC).

The amount of SNAP benefits a household receives depends on the household size and income. The maximum monthly benefit amounts for Texas are shown in the table below:

| Household Size | Maximum Monthly Benefit |

|---|---|

| 1 | $281 |

| 2 | $459 |

| 3 | $636 |

| 4 | $813 |

| 5 | $990 |

| 6 | $1,167 |

| 7 | $1,344 |

| 8 | $1,521 |

To calculate the SNAP benefit amount, HHSC subtracts 30% of the household’s net income from the maximum monthly benefit amount. The resulting amount is the household’s SNAP benefit.

Conclusion

In conclusion, the maximum income for food stamps in Texas is determined by household size and varies based on federal guidelines. Understanding these income limits is crucial for individuals and families seeking assistance through the SNAP program. By providing nutritional support to low-income households, SNAP plays a significant role in combating food insecurity and promoting the well-being of communities across Texas.

FAQ Corner

What types of income are considered for SNAP eligibility?

SNAP considers various types of income, including wages, self-employment income, Social Security benefits, unemployment compensation, and child support payments.

Are there any assets that are exempt from the SNAP asset limit?

Yes, certain assets are exempt from the SNAP asset limit, such as a primary residence, one vehicle, and retirement accounts.

Who is exempt from the SNAP work requirements?

Individuals under 18 or over 59, pregnant women, people with disabilities, and full-time students are exempt from the SNAP work requirements.